What is Included in a Home Warranty?

Home warranties differ, as providers offer a variety of contract terms. Fortunately, there is a home warranty service plan to fit almost any budget and need. However, to ensure optimal coverage, homeowners must review the terms to verify inclusions and exclusions. Discover what is typically covered in a home warranty and what to look for when shopping for a service plan.

Table of Contents

What is a Home Warranty?

A home warranty is a contract that provides repair, replacement, or service of household appliances and systems. Homeowners’ insurance and warranties are different, as insurance covers unexpected events, while a warranty covers systems and devices listed in the contract. Understanding what your warranty covers involves reading the contract to find out the specific appliances and systems that are covered under the terms.

Typical Coverage

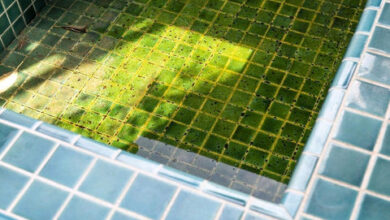

Most warranties cover specific systems, such as electrical, heating, indoor plumbing, ductwork, and water heaters. Additionally, household appliances may include the oven, dishwasher, washing machine, clothes dryer, refrigerator, air conditioning, garage door opener, and pool equipment. Often, some of these items are optional, and homeowners should review the contract terms with the provider to ensure the proper coverage of all necessary appliances and systems.

Specific and Optional Coverage

Homeowners can also pick the coverage they want by choosing warranty companies that cover certain systems, such as spa equipment or heating systems. Plus, there are appliance warranties that work similarly, allowing homeowners to get coverage on only items they want to have listed in the contract. Also, adding systems helps homeowners get the coverage they need to service, repair, or replace items such as garbage disposals and ceiling fans.

How Home Warranty Coverage Works

Home warranties are available for new homes and older ones. Most home warranties do not cover pre-existing issues or appliances and systems that were improperly maintained. Typically, the warranty covers each item up to a specific amount, such as $500. Some policies have a deductible for the policyholder to pay before coverage starts. The warranty may cover service, repair, or replacement, based on the condition of the item.

More to Know About Home Warranties

A home warranty offers homeowners assurance they will be able to fix expensive items when broken or in disrepair. A homeowner must file a claim, then a service provider schedules an appointment to see the appliances or systems. Usually, coverage is provided within three to five days after a claim is filed by the policyholder. The times and claim amounts vary based on the policy.

How Much Does a Home Warranty Cost?

Most homeowners discover a home warranty pays for itself over the years. With that in mind, the cost of coverage depends on many factors, such as the size and age of the house and its location. Plus, extended coverage will cost more than covering the basics around the house. However, homeowners should include all necessary items in the warranty coverage so they don’t have to pay to fix or replace them in the future. The coverage a homeowner invests in today will take care of fixing things tomorrow.

A home warranty provides essential peace of mind to homeowners. Instead of struggling to cover repair or replacement costs, a policyholder contacts the warranty company to get help quickly. Plus, the homeowners never have to deal with the hassles of having non-working systems until they can afford to fix them.