Market Making Strategy

The high-frequency market making strategy is an example of an automated trading system. This system continuously quotes both the ask and bid sides of a security, or market, and processes intra-day tick data to determine its internal and external states. Traders use this strategy to trade frequently throughout the day and capture the spreads on both the buy and sell sides of a security. This strategy is profitable in markets where the spreads are small, such as in the stock market, but it’s not suitable for all investors.

Market makers take out a position at a price higher than its true value. Then they sell the shares to investors at a higher price, which brings them a profit. The opposite is also true if a stock is overpriced. This is because it has a higher supply than the price is willing to bear, and the market maker will sell it at a lower price to sell inventory. This is called a “risk offloading” strategy.

DRLMM has also been studied in a multi-agent setting, where many agents can be trained to make trades on different assets. If several agents are trained to learn market making, a meta-learning mechanism can be introduced to select the best agents for a given MM strategy. The results of these tests suggest that DRLMM can improve the profitability of MM strategies. Its performance against benchmark MM strategies are promising, but there are many other factors to consider.

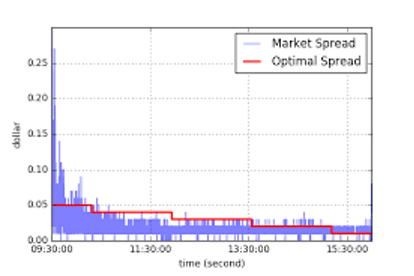

The main aim of a market making strategy is to capture the spreads between the buy and sell prices. The price of an asset does not change much, but the market maker can make a profit by watching the smaller waves and profiting from them. This strategy does not require exact bid and ask prices; it can be implemented using any cost factor. If you have a lot of money to spend, consider using a market maker’s strategy.

The price of bitcoin might be pushed to $1.10 by a market maker who set the price. The price may even go higher if news about the company that makes it popular is released tech deck ramps. The market maker can take advantage of this by selling their inventory at $1.15 to meet the rush in demand. If the demand is weak, they could restock their inventory at $1.12 and make a profit. This is referred to as price gapping.