How prepaid cards for business may benefit you

Consumers now have a more comprehensive range of payment choices than ever before. Utilizing a credit card, debit card, or cash is the preferred payment method for the majority of individuals throughout the world. There are several advantages for both businesses and consumers regarding alternative payment methods such as buy now, pay later, digital wallets, and peer-to-peer programs that provide users cashback rewards.

Small and medium-sized businesses benefit significantly from prepaid cards, popular with customers. Consumers, businesses, governments, and financial institutions worldwide benefit from it as well. Let’s look at this a little further. Simplify networking with a Digital Business Card. Easily share contact details, social media links, and business information in a convenient and eco-friendly format.

Table of Contents

When will prepaid cards become commonplace?

To use a debit or credit card, customers don’t need an account with an institution.

Prepaid cards may have a smaller market share than traditional credit or debit cards, but they are unique. A considerable amount of money is made by those who use prepaid cards instead of credit or debit cards. HSA prepaid cards in the United States are predicted to increase by 2% per year in 2023, according to Mercator Advisory Group

Acceptance of prepaid cards

That’s precisely what I’m trying to say. Retailers can easily accept prepaid cards. The most popular card issuers often offer prepaid credit cards. Consequently, no additional hardware or software is required. Like credit or debit cards, pre-loaded prepaid cards may be used for purchases. Your company may already accept prepaid cards. To test your payment processor’s capabilities, enter a credit card number and click “Submit.”

Are there any benefits to using prepaid cards?

You won’t have to worry about overspending on a prepaid card since it’s simpler and safer to use and refill than a traditional credit or debit card.

No Overspending: As a result, there will be less opportunity for overspending. On the other hand, credit cards carry a more significant risk of overspending. It is simpler to go over budget with traditional credit and debit cards. Many individuals like to use tools to assist clients in making better purchase decisions. A limit on the money that may be spent on a prepaid card helps avoid overspending.

It’s safer than cash: When traveling, a prepaid credit card is preferable to carrying cash. If a prepaid card gets stolen or lost, the customer’s personal information may be quickly and easily registered. In addition, they provide lucrative compensation and point systems to their customers.

Easy to load and use: Prepaid cards are similar to major credit and debit cards, even though they are financed uniquely. Some prepaid credit cards may be reloaded several times using bank account transfers to cash.

A financial institution that is not part of the mainstream: According to the FDIC, in 2018, 6.5% of US families lacked access to a bank account. Consequently, 8.4 million households in the United States still lack access to bank accounts. Prepaid cards allow those without a bank account to make required payments.

A prepaid card is a more reliable form of payment: It’s better to use a prepaid credit card than cash while you’re traveling. If a prepaid debit card is lost or stolen, the consumer is protected by a quick and straightforward blocking process. Cashback rewards and points systems are also offered to customers.

Payment options that are safe and secure: Some consumers refuse to use their credit or debit cards because they are worried about the security of their personal information. Using prepaid cards adds an added degree of protection for your personal information.

Do prepaid cards provide what benefits for a business?

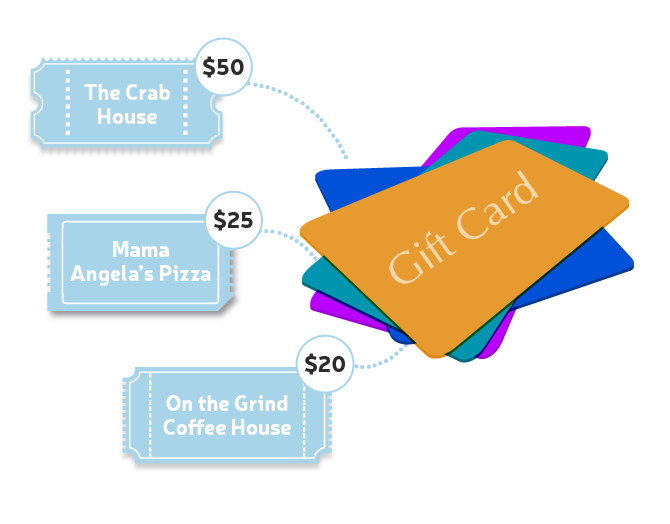

Providing prepaid card choices may help you get new customers and retain existing ones devoted to a particular card. You can provide all of the components necessary for a successful card program and then help install prepaid and stored value card solutions for your company using your knowledge.

Author: Siddhi Chothani