What are the benefits of asset allocation?

When we run a business, we prefer to invest our money to get some balanced returns. The business needs to build a portfolio that creates a proper balance between risk and reward. The financial professionals in the business think that asset allocation is very important. Know that there are three main asset classes- equities, fixed-income and cash and cash equivalents. All these have different levels of risks and returns, so a loss in one may be covered by the returns in another.

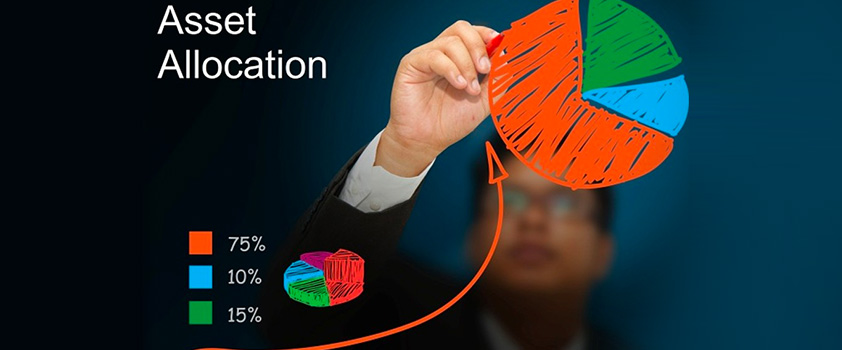

In simpler terms, asset allocation means distributing your investments in equity, debt, gold, real estate, etc. It is kind of bringing in diversification in investments, making sure that the whole investment does not get lost in a single go. To know about types of asset allocation, follow the following points:

- Fixed income class- This is one of the most preferred and oldest forms of investment. It includes investments like government bonds, corporate bonds, securities etc in which investors are given interest till the maturity date.

- Real estate- This is a long-term investment in which the investor invests in lands, building, flats etc. As this is long-term, one can expect huge returns in future but this form of investment lacks liquidity.

- Cash- If you are looking for those investments which have high liquidity, you can go for commercial papers, treasury bills etc. These have a maturity date within a year.

- Equity- You can also invest in shares of different companies. You can sell and purchase the shares as per the market condition.

If we deeply sink into the term asset allocation and diversification, asset allocation is done based on income flow, age, investment needs etc whereas diversification is a strategy to allocate the funds to earn more rewards and reduce risks. Also, know that while diversifying, one must have an understanding of proper holding and selling of the investments.

Following are some of the benefits of asset allocation and diversification:

- Risk diversification- By bringing diversity in risk diversification, you can expand your investment portfolio in such a way that will help you to get more benefits. If done right, it will help in multiplying your returns in no time. For example- you invested in shares and gold. If you face a loss in shares, you can balance it out with the profit in gold, to some extent. So, one who have investments in more than one area, will surely easily survive the market losses.

- Stable returns- You have done the asset allocation right, it is sure that you will earn stable returns from it. This will help in reducing the risk of investment and increase the returns. So, in short, it will help in increasing the stability and reliability of the investments made.

- Low volatility- Know that every investment has some returns and rewards connected with it. The right asset allocation and diversification will reduce or balance the investment volatility. It is obvious that the higher the volatility, the higher will be the risk.

- Maintains discipline- It will help the investment, not to over or under-invest in a particular investment. This will help in allocating the investment proportionately, creating a balance between returns and risks. It will help the investor not to act greedy, making sure there is enough discipline in the investor.

- Reduces stress- When the investor will allocate the investments, the risk of loss will be reduced. Investing in multiple asset classes will reduce the stress. This will foster you with the confidence to invest in other assets. As the risk will be less, it will reduce the level of stress among investors.

So aboveare some of the benefits of asset allocation and diversification. Determining the right mix of investments is essential to increase returns and reduce risks. Many factors affect the asset allocation decision. Some of the common factors are personal financial goals, risk appetite, investment horizon and much more. Some of the factors are explained below:

- Time of horizon- It depends upon the investor’s preference to invest in a particular period. The different time periods will give your different risk levels. Know that long term investments will have high risk but one can expect huge returns in the end and vice-versa.

- Risk tolerance- The type of investment made depends upon the level of risks one can handle.

- Risk and return- It is important that the risk and return have a perfect balance. If one is taking a high risk, he/she can expect to get greater returns as per the expectation.

So above are some of the factors which might affect the asset allocation and diversification decision. If you are looking for some investments, you can visit ‘Wealth Desk’ as they will guide you to invest in a basket of stocks and ETFs based on your idea and strategy.