The Role of Smart Contracts in Decentralized Exchanges (DEX)

Decentralized Exchanges (DEX) have emerged as a crucial component of the cryptocurrency ecosystem, offering users a trustless and permissionless platform to trade digital assets. At the heart of these exchanges lies the innovative technology of Smart Contracts, which play a pivotal role in facilitating seamless and secure transactions. This article delves into the intricate relationship between Smart Contracts and DEX, exploring their functionalities, advantages, challenges, and future prospects. DEX has made crypto accessible worldwide similar to how education firms like Immediate Lidex are making investment education available to everyone across the globe. Connect with an educational expert and begin learning!

Table of Contents

Understanding Smart Contracts

Smart Contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts operate on blockchain networks, ensuring tamper-proof execution and immutable record-keeping. Unlike traditional contracts that rely on intermediaries for enforcement, Smart Contracts automatically execute predefined actions when specific conditions are met. This automation streamlines processes, reduces costs, and minimizes the risk of fraud or manipulation.

Evolution of Decentralized Exchanges

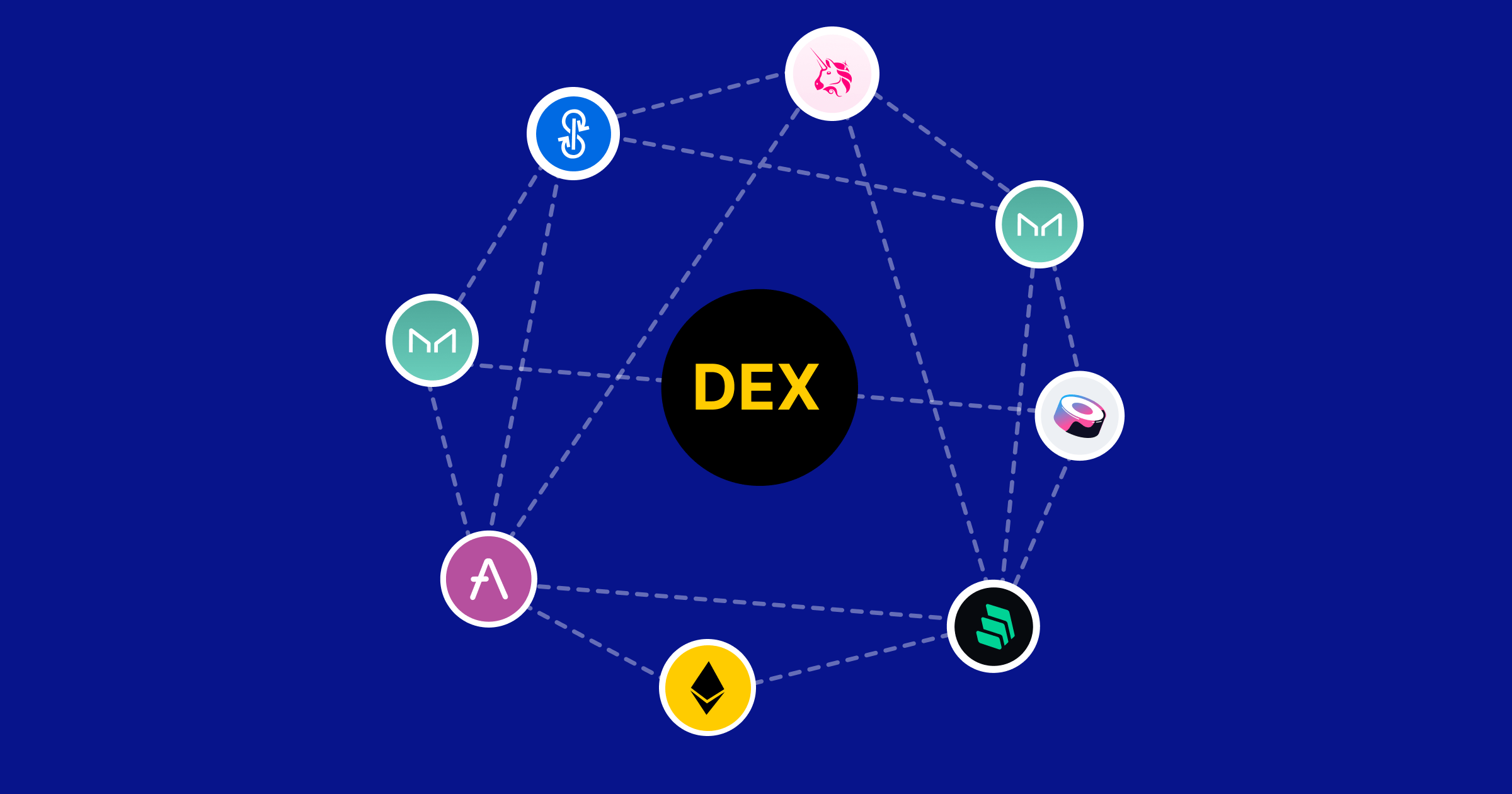

Early iterations of DEX faced challenges such as low liquidity, limited asset support, and suboptimal user experience. However, with the advent of Smart Contract-based DEX platforms, significant improvements have been made. These platforms leverage the capabilities of Smart Contracts to automate order matching, execute trades, and manage liquidity pools. As a result, DEX has witnessed rapid growth and adoption, attracting both retail traders and institutional investors seeking decentralized alternatives to centralized exchanges.

Key Features and Mechanisms of Smart Contracts in DEX

Smart Contracts empower DEX with several key features and mechanisms that enhance their functionality and efficiency. Automated order matching and execution algorithms ensure timely and accurate trade settlements without the need for intermediaries. Furthermore, Smart Contracts provide a high level of security and transparency by recording all transactions on the blockchain, thereby mitigating the risk of fraud or manipulation. Additionally, Smart Contracts play a crucial role in liquidity provision by facilitating the creation and management of decentralized liquidity pools, which enable users to trade assets seamlessly.

Advantages and Challenges of Smart Contracts in DEX

The integration of Smart Contracts in DEX offers numerous advantages, including the elimination of intermediaries, enhanced security and trustlessness, and global accessibility. By removing centralized authorities from the trading process, Smart Contract-based DEX empower users to retain full control over their assets and transactions. However, challenges such as scalability issues, Smart Contract vulnerabilities, and regulatory concerns pose significant hurdles to widespread adoption. Addressing these challenges will be essential for the continued growth and development of Smart Contract-based DEX platforms.

Case Studies: Successful Implementation of Smart Contracts in DEX

Several DEX platforms have successfully leveraged Smart Contracts to offer innovative trading solutions. Uniswap, for example, pioneered the Automated Market Maker (AMM) model, which enables users to trade assets directly from decentralized liquidity pools. SushiSwap, another prominent DEX, introduced community-driven governance mechanisms to incentivize participation and reward liquidity providers. Similarly, PancakeSwap has capitalized on the popularity of the Binance Smart Chain (BSC) ecosystem to attract users and liquidity.

Future Perspectives and Innovations

Looking ahead, the future of Smart Contract-based DEX holds tremendous potential for innovation and growth. Scalability solutions such as layer 2 protocols and sharding techniques aim to address the scalability limitations of blockchain networks, enabling DEX to handle a higher volume of transactions. Interoperability initiatives seek to bridge the gap between different blockchain networks, facilitating seamless asset transfers and cross-chain trading. Moreover, the integration of advanced features such as oracles and prediction markets will further enhance the functionality and utility of Smart Contract-based DEX platforms.

Conclusion

In conclusion, Smart Contracts play a critical role in the success of Decentralized Exchanges by enabling automated, transparent, and secure transactions. Despite facing challenges, the integration of Smart Contracts in DEX has revolutionized the way digital assets are traded, empowering users with greater control and autonomy. As the cryptocurrency ecosystem continues to evolve, Smart Contract-based DEX are poised to play an increasingly important role in shaping the future of finance.