How to Be Qualified for a Bad Credit Loan in the US

If you’re thinking about applying for loans for bad credit, it’s important to make sure you’re aware of the risks involved. These loans tend to have higher interest rates and fees than traditional loans, so it’s important to make sure you can afford to repay the loan on time.

Table of Contents

What Is Considered a Bad Credit Score?

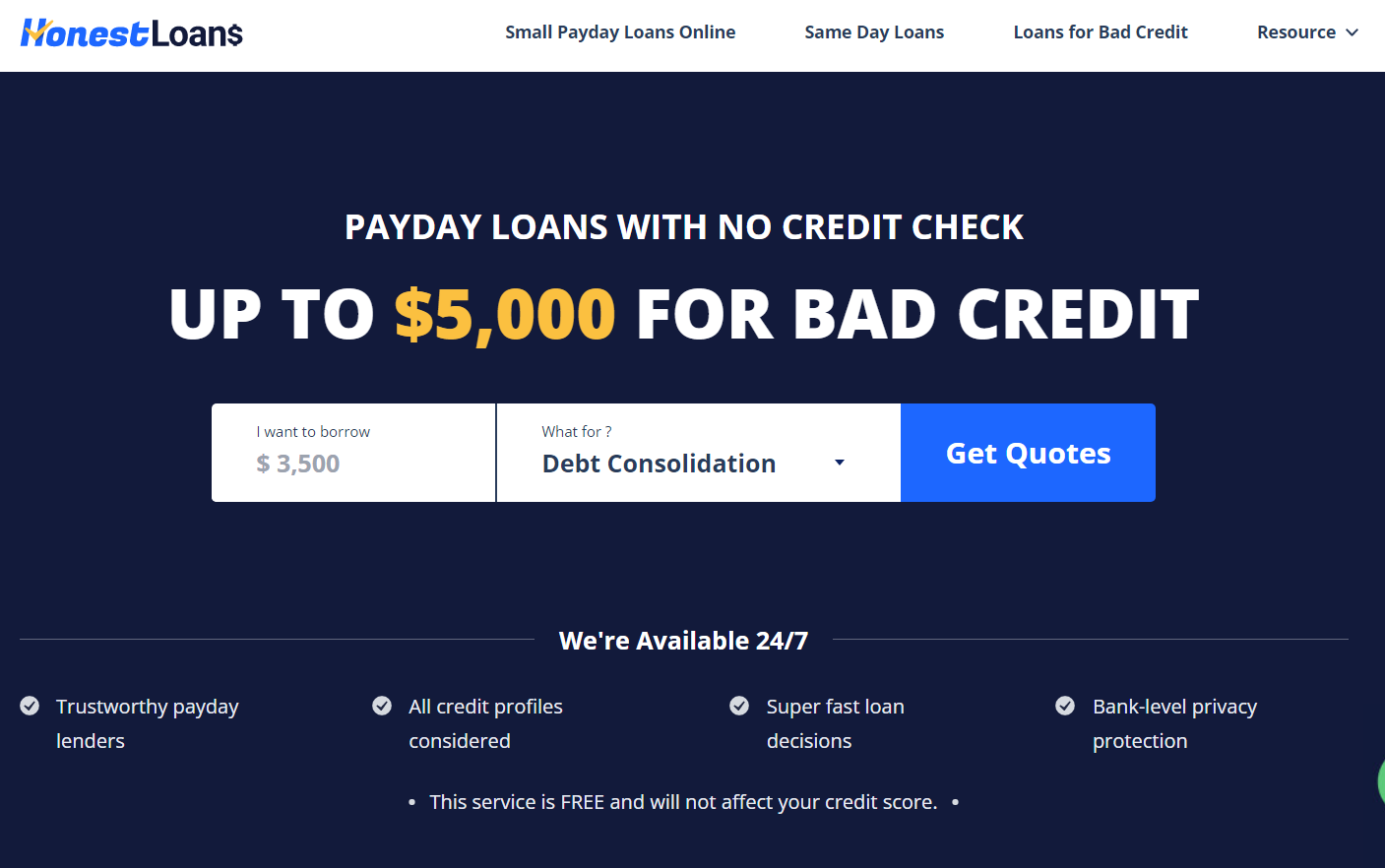

Different lenders have different opinions on what is a bad credit score, and what range of credit scores constitutes a “good” credit score varies as well. HonestLoans is a great service that connects lenders for borrowers who need loans for bad credit online.

Generally, however, if your credit score is below 600, you will have a hard time getting a loan or a credit card. And if your score is below 500, you may have trouble getting any kind of credit at all.There are a few things that can cause your credit score to drop.

If you have missed a few credit card payments, or if you have a high amount of debt, your credit score will drop. Additionally, if you have applied for a lot of credit in a short period of time, this will also have a negative impact on your score.

How Soon Could I Receive Bad Credit Loans

Your credit score is one of the most important factors, as lenders will want to make sure you are a low risk borrower. Other factors that will affect your application include your income, employment history, and credit history.

If you have a good credit score, you may be able to receive bad credit loans within a few days. However, if your credit score is lower, it may take a few weeks or even months before you are approved. Lenders will also want to make sure you are able to afford the monthly payments on the loan, so be sure to factor in your monthly expenses when applying.

If you are in need of quick cash, bad credit loans may not be the best solution. However, there are a number of other options available, including credit cards and personal loans. Be sure to compare your options and choose the one that best suits your needs.

Looking for bad credit loans? Contact us today to learn more about our products and how we can help you get the cash you need.

The Benefits of Loans for Bad Credit Online

If you’ve been struggling to get a loan because of your bad credit, you may be wondering if there are any benefits to loans for bad credit online. The answer is a resounding yes! In fact, there are several benefits to securing a loan online, even if you have bad credit.For starters, online loans tend to be much more accessible than traditional loans. You can usually apply for an online loan with just a few clicks, and you don’t have to go through the hassle of visiting a bank or credit union. This means that you can apply for a loan from the comfort of your own home, and you can get a decision relatively quickly.

Another benefit of online loans is that they often have lower interest rates than traditional loans. This is because online lenders have lower overhead costs than traditional lenders, so they can offer lower interest rates to borrowers. This can be a major boon to borrowers who are struggling to pay down high-interest debt.

Finally, online loans can be a great way to rebuild your credit. By making on-time payments on a loan that you can afford, you can improve your credit score and start to rebuild your credit history. This can be a great way to get back on track after a financial setback.

So if you’re looking for a way to get a loan with bad credit, online loans are a great option. They are more accessible than traditional loans, they have lower interest rates, and they can help you rebuild your credit.

The Alternatives of Bad Credit Loans

Bad credit loans are becoming a more and more popular way for people to get money in a hurry. However, they are not always the best option. Here are a few alternatives to bad credit loans.1. Ask family and friends for a loan. This is probably the most obvious alternative to a bad credit loan. If you have a friend or family member who is willing to loan you money, it can be a great option. Just be sure to have a plan for repaying the loan.

2. Use a credit card. If you have a credit card, you can use it to get a cash advance. This can be a good option if you need money quickly, but be careful not to get into too much debt.

3. Use a personal loan. If you don’t want to use a credit card, you can get a personal loan from a bank or credit union. This can be a good option if you need a large amount of money and you want to pay it back over a longer period of time.

4. Use a home equity loan. If you have equity in your home, you can use it to get a home equity loan. This can be a good option if you need a lot of money and you want to pay it back over a long period of time.

5. Use a car title loan. If you have a car, you can use it to get a car title loan. This can be a good option if you need a small amount of money and you want to pay it back over a short period of time.

6. Use a personal loan from a lending company. If you don’t want to use a bank or credit union, you can get a personal loan from a lending company. This can be a good option if you need a small amount of money and you want to pay it back over a short period of time.